The Chancellor of the Exchequer, Rishi Sunak has today outlined the latest spending plans in the Budget for 2021, as we deal with a post-covid economy.

The Chancellor first sent best wishes to leader of opposition, Sir Keir Starmer who tested positive for Covid-19. He then began to by saying the government is aiming for stronger economy for the British people stating growth up, jobs up and debt down which is supported by £150billion additional funding being made available across all government departments for increased spending.

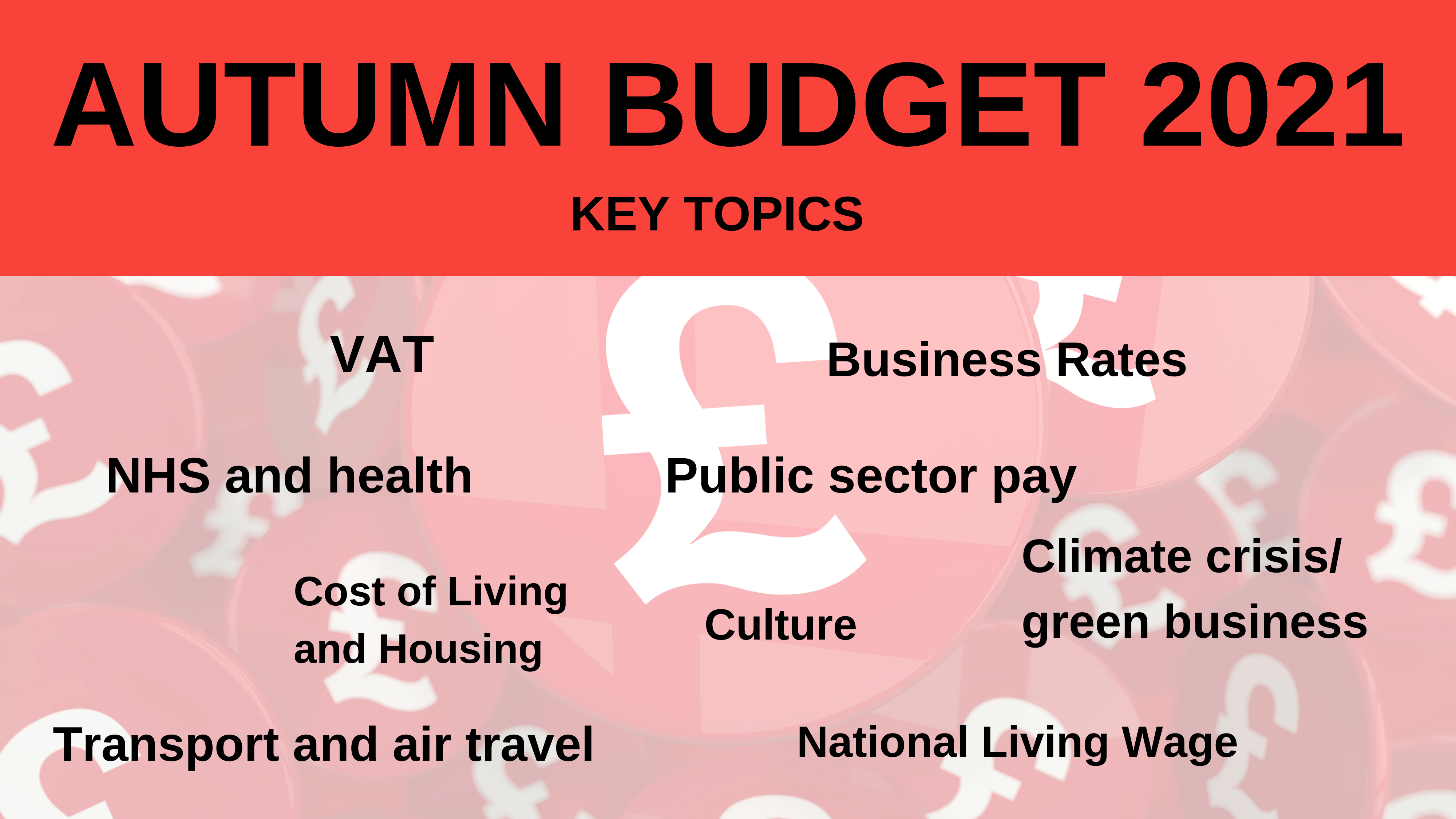

ECONOMY UPDATE

- 3.1% inflation, likely to rise further

This is due to an increased demand for goods and issues with supply, and the surge in global demand for energy. Oil, coal and gas prices have doubled. It will take months to ease but it is a shared global problem. - Ready to act against global fuel uncertainty

The government is ready and willing to act against global fuel uncertainty and will be responsible with public finances. - Economic recovery is expected to be quicker than previously forecast

OBR (Office for Budget Responsibility) expects pre-covid level of economy at the turn of the year.

It predicts that gross domestic product (GDP) to expand by 6.5% this year compared to the 4% it forecast at the Budget in March. All four fiscal rules have been met according to OBR - Wages are rising by almost 3.5%

- 0.7% will go to international aid (up from current 0.5%)

At the projected rate of recovery, Britain can help worlds poorest too. 0.7% will go to international aid before 2024/25

BUSINESS UPDATE

Business Rates and Tax Relief

- Business rate evaluation

Business rate evaluationswill take place every 3 years starting 2023. The Chancellor explained it would be irresponsible of the government to get rid of business rates totally as they generate significant revenue. The planned, inflation linked increase in the Business Rate multiplier has also been cancelled. - New business rates property improvement relief

From 2023 businesses can make property improvements and pay no interest rates. - Extended tax relief for museums and galleries.

Tax relief for theatres, museums, galleries, will also be doubled until April 2023, - Hospitality, retail and leisure, business rate cut by 50%

For one year there will be a new 50% business rate discount for hospitality and leisure businesses, for one year, capped at £110,000. This is the biggest tax cut in over 30 years – cut by £7 billion. - Draught duty relief on beer and cider from draft containers cut by 5%

This will benefit community pubs the most. Duty cut by 5%. Permanent cut from February 2023. - Planned increase of duty on spirits, beer and wine cancelled from tonight.

- New green investment relief

To encourage businesses to adopt green solutions like solar panels. £750million will to go towards incentives for businesses to go green.

Fuel prices

Fuel duty rise will be cancelled. The average tank will cost £15 less for cars, £130 less for HGVs.

Lower rate of air passenger duty

- Air passenger duty (APD) will be cut by half for travel between England, Scotland, Wales and Northern Ireland.

- APD for long haul flights to increase to offset carbon emissions from international flights.

Investing in education and work skills

- £3.8billion to go to skills

T Levels to increase – new courses, the equivalent of 3 A levels – are a combination of classroom learning and on-the-job experience in industry placements.

Adding more places for skills bootcamps.

More funding for apprenticeships. - New numeracy programme for improving basic maths skills

Transport

As part of the government’s infrastructure revolution;

- £21 billion to go on roads

- £46 billion to railways across the country

Health and NHS

- £5.6billion to the NHS and health services. To help fund new hospitals, better screening technology, 50,000 more nurses and more training.

Homes

- £1.8billion for new homes

- £5billion to reduce unsafe cladding on modern high rise buildings, with 4% levy for housebuilding developers to go towards the cost.

Policing

- 20,000 new police officers

- Extra £2.2bn for courts and rehabilitation services.

- £3.8billion to prison building

Schools

- £4.7 billion going to schools – increase per pupil funding, 1500 per child, SEND (Special Educational Needs) children to have 30,000 new school places

Communities

- £560m for youth services

- £200m 800 football pitches

- New pocket parks

- 1.7billion in over 100 local areas

- Museums and libraries to be refurbished

Public sector pay rises

National living wage increasing by 6.6% to £9.50 an hour. Brings us closer to a high wage, high skill economy of the future.

Taxes

Taxes rising but due to the measures we had to take during the pandemic. The government does have limits, but can’t solve every issue. It will aim to reduce taxes by the end of this government, and will reward work.

Universal credit

Chancellor confirms that he will cut the universal credit taper rate from 63% to 55%. To help families to keep more of their pay on universal credit, on average £1000 a year. The Chancellor says it will be introduced by no later than 1 December 2021.